The cost of car insurance is skyrocketing. It’s critical to know that the coverage you carry now, has a huge impact on the price you pay when shopping for a new policy.

It sounds counterintuitive, but one of the most understated reasons your car insurance premium may be high, is because your carrying inadequate liability coverage.

Consider this…

If you’re an insurance company, you’re not a charity. Your overriding goal is to collect more in premiums than you pay out in claims. To accomplish this, insurance companies rely on hard data to appropriately price policies, and evaluate the risk of potential claims their customers may file in the future.

Most people understand the key data points used when setting premiums. Driving and claim histories, credit, gender, geographical location, vehicle type, age, etc.

A surprising factor companies consider, is how their current and potential customers mitigate the threat of financial risk. Insurance companies determine this by evaluating how much liability insurance these customers have purchased in the past.

- People who understand that anything can happen, and invest money in protecting their finances, tend to be more profitable customers overall. These customers are often rewarded with a lower insurance premium when shopping for a new policy, than if they had just carried their state-mandated coverage amounts.

We recommend that all of our clients purchase bodily injury limits of $100,000 per person, $300,000 per accident, and at least $50,000 for property damage liability to get the best prices and increased protection.

Why does carrying more coverage, help insurance rates when shopping?

In addition to providing you with better protection, insurance companies have realized that even though they may have to pay more in the event of a claim, lower-risk customers tend to buy better coverage. I’m no actuary, but clearly, this is supported by hard data or insurance companies wouldn’t factor it into their pricing.

To illustrate how significantly this can impact your premium, here is an example of a recent proposal I worked on for a new customer.

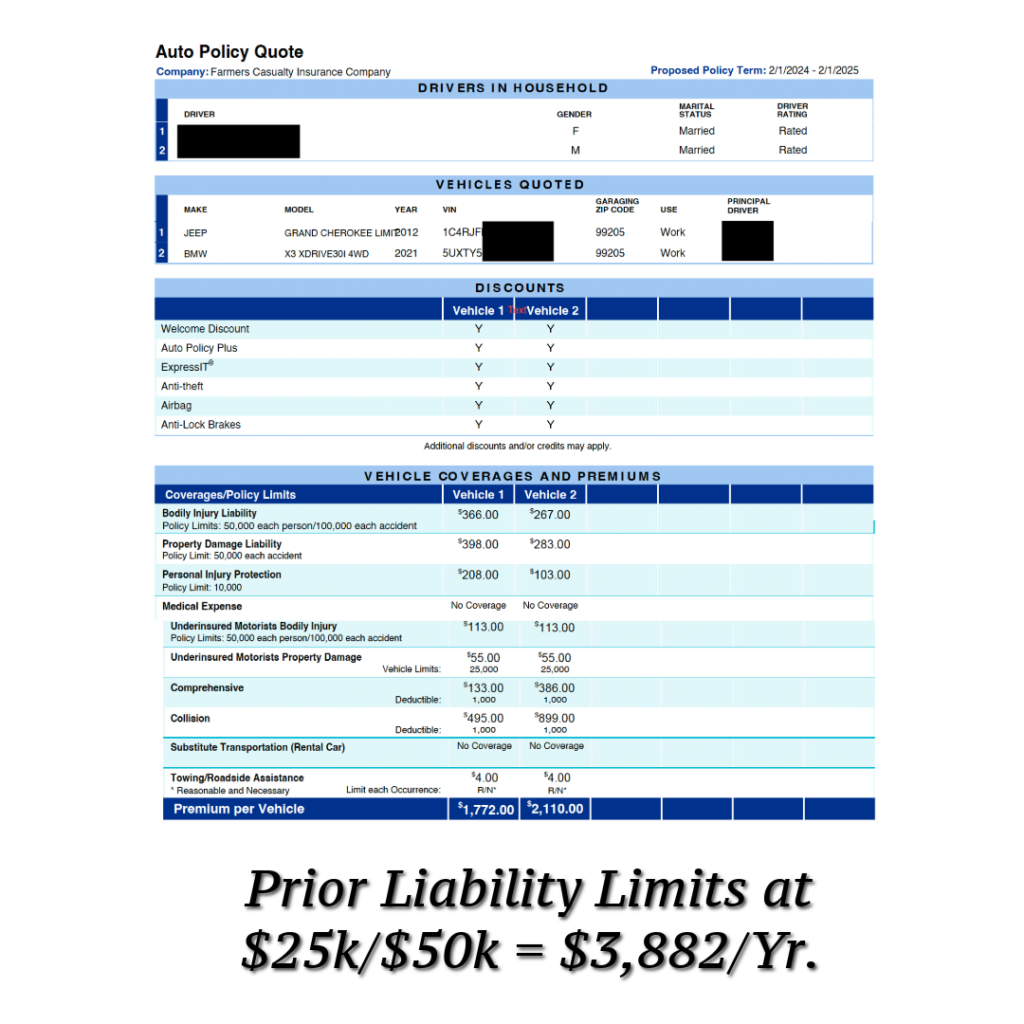

His current auto insurance policy had bodily injury limits of $25,000 per person, $50,000 per accident, and $10,000 for property damage. In other words, the Washington State minimum required liability insurance coverage.

Here’s a proposal we obtained for a new customer that carried $25k/$50k/$25k on his current plan in Spokane, WA.

Prior limit of $25k/$50k = $3,882 per year.

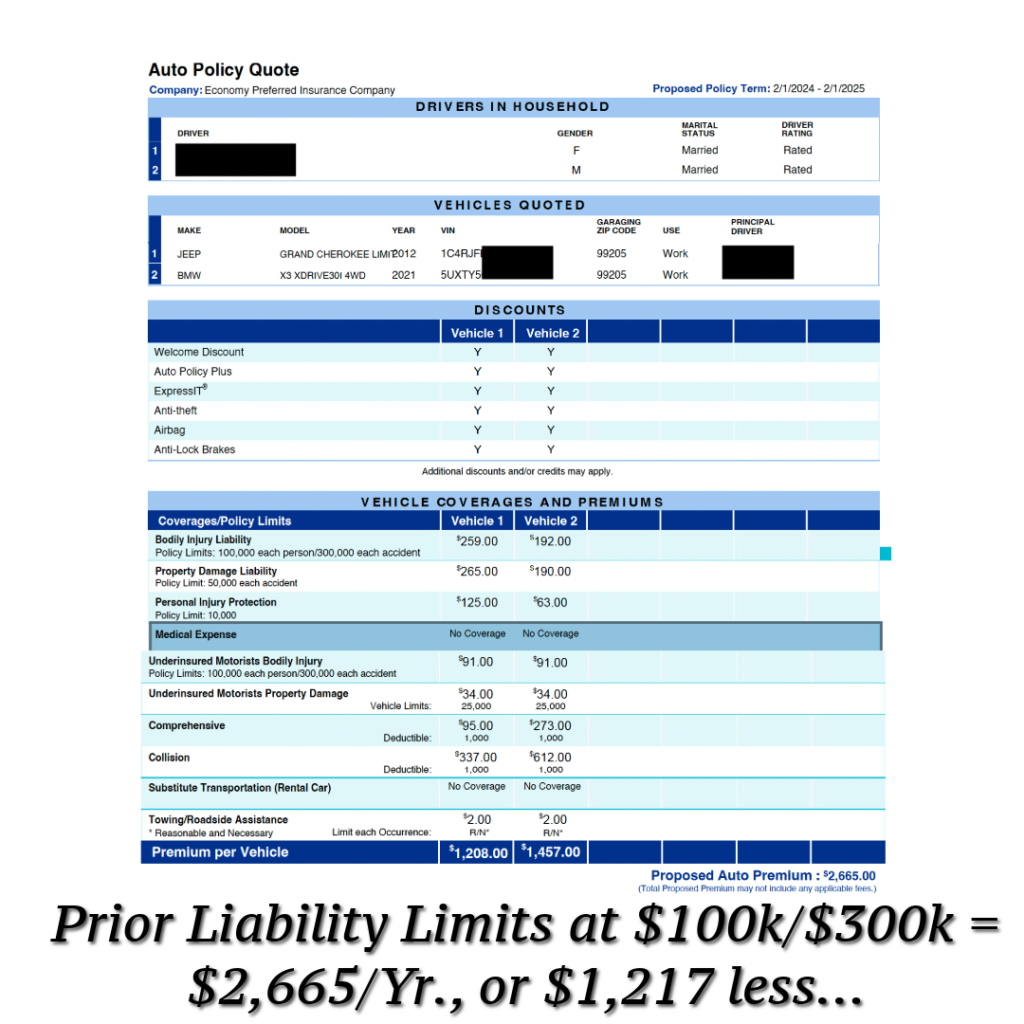

Here is the same customer’s price, had he purchased $100k/$300k from his previous insurance company.

Prior limit of $100k/$300k = $2,665 per year.

This customer’s premium was over $100 per month more expensive because his previous coverage was just the state-required insurance limit.

This example is extreme, but it’s not uncommon. The “Prior limits” factor is a primary driver of the insurance rates for most car insurance companies in Washington, Idaho, Oregon, Montana, and Arizona, the states we conduct business.

How do insurance companies get my current policy information?

Most insurance companies pay to obtain information, and subsequently feed into a database which (among other things) verifies the amount of coverage you have on your current policy. We refer to it as “pre-fill”. There’s usually a 30 day delay in between when a change is made, and when it reflects in this pre-fill database. If you have recently increased your coverage, it may take a period of time for this to reflect. They may ask you to provide a copy of your declarations page to verify this info if it differs from the database. The length of time necessary before an insurance company will account for higher prior limits varies, but generally carriers want to see you have maintained a higher level of coverage for at least 6 months.

Naturally, if you call your insurance company today and increase your liability coverage amount, you’re going to experience some sort of premium increase for this additional protection. But the potential cost savings in the long run, are likely to outweigh the short-term increase.

There are of course many rating factors used when pricing your policy, so this is in no way a guaranteed way to grant you lower rates. But there is a good chance that if you are an otherwise safe, responsible driver, or even if you have a minor traffic infraction or a small claim on your record, knowing this strategy may give you a meaningful reduction in the cost of car insurance in the medium to long term.