Renting a car is a great way to maintain mobility and independence when traveling. If your planning on a trip, typical costs include lodging, food, entertainment, and transportation. If your preferred transportation when traveling is a rental vehicle, it’s important to understand your coverages and costs up front so you can budget appropriately. Rental car insurance is one of those costs.

In short, whether it’s Turo, or Enterprise, most US insurance policies provide automatic coverage for a substitute passenger vehicles (such as a rental) for up to 30 days automatically. Typically, the broadest coverage you carry on your personal auto policy, extends to a substitute vehicle as well.

The broadest coverage you carry, means your lowest deductible for collision and comprehensive coverage, and the highest liability limit on your car insurance policy.

When it comes to deciding whether or not you should purchase the insurance offered by the rental car company, here’s some examples of what their insurance covers.

- The physical damage insurance offered by rental car agencies typically have a $0 deductible for damage. If you bring the car back with a large dent, you shouldn’t have to pay anything additional out of pocket towards the repair.

- Car rental agencies also offer additional liability coverage. Enterprise for example, sells an additional liability limit of $300,000 towards the property damage, and bodily injury caused to other parties.

- Car rental agencies usually offer a roadside assistance plan, and also coverage for personal property.

In general, these coverages can be purchased individually, or as a package. Purchasing both the physical damage insurance, and the liability coverage costs between $40-$50 a day. The cost varies depending on the vehicle, and the location your traveling to.

Now for some context.

As an example, your personal auto policy has a $500 deductible for collision and comprehensive, and $100,000/$300,000 in liability coverage.

Lets assume your renting a car in Vegas for 3 days.

In addition to the daily rental rate, the car rental agency offers their insurance at an additional cost of $45/day. If your unfamiliar with the driving habits of people in Vegas and don’t like surprises, It would probably make sense to take them up on this. If you bring the car back with damage, or even if it’s hit in a parking lot and you weren’t aware of the damage, you wont have to pay anything additional.

If you rely on your personal insurance however, typically the rental car agency will demand payment of your deductible up front. They may also charge you for their lost rental income due to the number of days they will be unable to rent out the car; many personal auto policies wont cover this expense. Additionally, if you have to make a claim on your insurance, it’s entirely possible this claim will raise your rates.

It’s easy to see how this could snowball into a larger expense than you bargained for.

Now lets say your renting a car in Phoenix for two weeks.

The car rental agency offers their insurance for $40/day. This adds $560 to the overall rental rate. Considering your deductible is $500, it might make sense to decline this coverage. Even if you brought the car back with damage, your deductible is less than the cost of their insurance. Savvy travelers may also inquire with their credit card companies. Many credit cards offer car rental damage insurance which helps with your deductible expense, and pays for loss of rental income to the car rental agency.

If your trip involves traveling to either Mexico or Canada, the coverage requirements are very different.

Many US policies will cover you while driving a car in Canada, whether its your own car, or a rental.

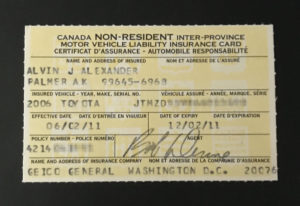

It’s important to know that Canada has higher minimum liability coverage requirements than the United States. In most provinces, the minimum coverage required is $200k. Canada also has a specific insurance card that you must obtain from your insurance company, or your agent.

Driving a car in Mexico is another matter.

It’s important to understand that most United States insurance policies will not cover you while driving a vehicle in Mexico, or if they do, will only cover you within a certain distance from the U.S. border; typically 10-15 miles from the closest U.S. border.

It’s not advised to rely on your personal auto insurance policy for coverage in Mexico. Traffic accidents can be treated as a criminal offense, and U.S. policies are not designed to provide the right insurance coverage.

If your driving or renting a car in Mexico, always purchase the coverage that the rental car agency provides, or is offered by a reputable Mexican travel insurance agent.